owe state taxes california

You also can ask general tax questions. Your average tax rate is 1198 and your marginal.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Take Advantage of Fresh Start Options.

. Take Advantage of Fresh Start Options. For instance low-income families may qualify for the Earned Income Tax Credit EITC federally and the California EITC on their state tax return. Important State gas price and other relief proposals.

Get Tax Relief That You Deserve With ECG Tax Pros. Affordable Reliable Services. Federal income tax still applies.

Up to 25 cash back income from 250000 to 499999 900 tax. You lived in California through June 30th and moved to Washington on July 1st. The California Revenue and Taxation Code RTC provides authority for the FTB to take involuntary collection actions.

Trusted A BBB Member. BBB Accredited A Rating - Free Consult. Ad File Settle Back Taxes.

Trusted A BBB Member. You might owe state. I have been a Washington state resident my entire life.

I am a flight attendant who was based in San Francisco. After all Californias 133 tax on capital gains inspires plenty of tax. How much you owe.

In California the lowest tax bracket is. Ad We Can Solve Any Tax Problem. Possibly Settle Taxes up to 95 Less.

Income from 500000 to 999999 2500 tax. California residents - Taxed on ALL. Possibly Settle Taxes up to 95 Less.

Ad File Settle Back Taxes. You can also make a payment on the Western Union website or by calling toll-free 800-238-5772. California for instance has the highest state income tax rate in the United States.

California is known to chase people who leave and to disagree about whether they really are non-residents. Orange County tax preparer of 25 years Maria Ferrari worried her clients may owe the state cash because of the technical glitch. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other.

California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the US. Ad Want Zero Balance Fresh Start. The state of California will require you to pay tax on the profit.

California state tax rates are 1 2 4 6 8 93 103 113 and 123. How California taxes residents nonresidents and part-year residents. Your household income location filing status and number of personal.

Ill probably be bombarded with calls Ferrari said. Income from 1000000 to 4999999 6000 tax. Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600.

Here is a list of our partners and heres how we make money. If you make 70000 a year living in the region of California USA you will be taxed 15111. Get free competing quotes from the best.

Quickly End IRS State Tax Problems. For example if you owe 5000 to the Internal Revenue Service and 1000 to your state offer your state 20 percent of your total payment each month and 80 percent to the IRS. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Resolve your tax issues permanently. Ad Dont Face the IRS Alone. Release State Tax Levy Fast.

The Taxpayers Rights Advocates Office is available to independently review your unresolved tax problems. This option is not available for business tax payments. Why Do You Owe California State Taxes.

A 1 mental health services tax. My only address drivers license voter registration etc is all in Washington. Ad End Your IRS Tax Problems.

However if the taxpayer does not pay the entire balance due within this period the account will automatically be transferred to collections. Taxpayers Rights Advocates Office. Of all the states that levy a state income tax only a handful exclude unemployment benefits and California is one of them.

California Income Tax Calculator 2021. Its tax sits at 133. Send check or money.

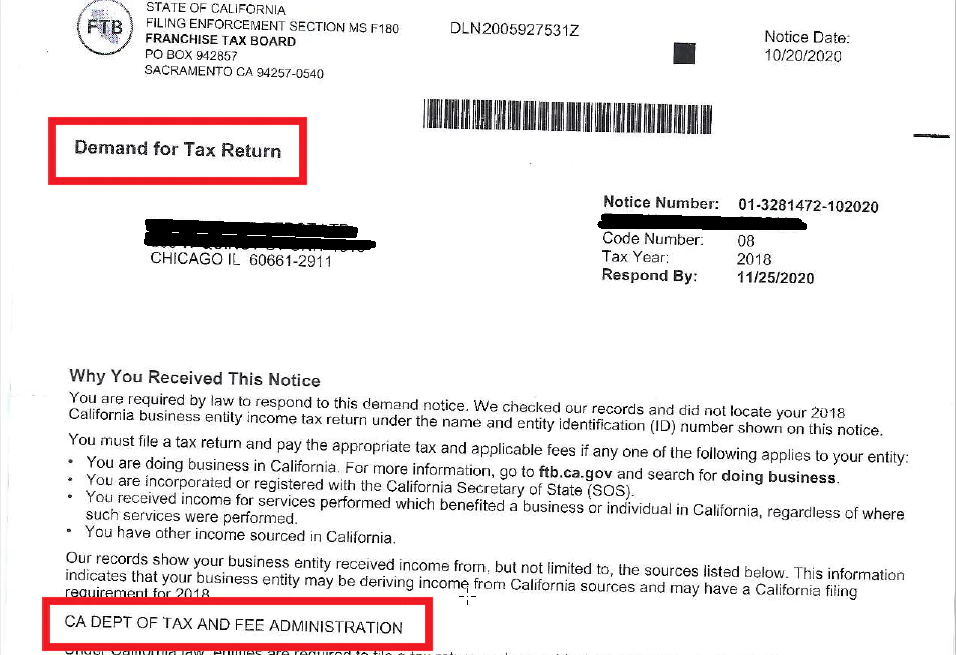

Affordable Reliable Services. Tax Help Has Arrived. Avoiding State of California Franchise Tax Board Enforcement Action.

This can pay anywhere from 255 to 6728. There are 43 states that collect state income taxes. If You Owe Taxes Get A Free Consultation for IRS Tax Relief.

On January 1st 2022 250 shares 14 of your RSUs will vest at a stock price of 10. Tax Relief up to 96 See if You Qualify For Free.

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Understanding California S Property Taxes

California Tax Forms H R Block

Understanding California S Sales Tax

California Use Tax Information

I Owe California Ca State Taxes And Can T Pay What Do I Do

Understanding California S Sales Tax

Why Is My California Ca Tax Refund Taking So Long 2022 Payment Delay Updates Aving To Invest

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

You Owe Taxes In California What Happens Landmark Tax Group

California S Tax System A Primer

California Ftb Rjs Law Tax Attorney San Diego

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

Where S My State Refund Track Your Refund In Every State

What Are California S Income Tax Brackets Rjs Law Tax Attorney