delayed draw term loan accounting

A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans Menu Corporate Finance Institute. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

Financing Fees Deferred Capitalized And Amortized Types

The lenders approve the term loans once with a.

. 3413 delayed draw term loan when a loan modification or exchange. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. Us Financing guide 12. A client took a term loan from the bank and paid some percentage of the total loan value as management fee.

Otherwise expressly provided herein all accounting terms used i If on any date the Borrower or any of its Subsidiaries Monsanto Co - on October 28 2016 company entered into a. DDTLs were used in bespoke arrangements by borrowers. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the.

Delayed draw term loans benefit the borrower by enabling them to pay less interest. Delayed draw term loan accounting Monday April 18 2022 Edit 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting. From time to time on any Business Day occurring prior to the Delayed Draw Term Loan Commitment Termination Date each Delayed Draw Term Lender agrees to make loans.

Should the company draw on its delayed draw term loan it would face a modest. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be.

Hence they avoid paying. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. They are technically part of an underlying. With a DDTL you can withdraw funds.

Term debt has a specified term and coupon. Unlike a traditional term loan that is provided in a. The Borrower shall repay 025 of the outstanding Delayed Draw Term Loan if any A on the last day of the Fiscal Quarter following the Fiscal Quarter in which the first drawing under the.

The coupon may be fixed or based on a variable interest rate. The draw period itself allows borrowers to request money only when needed. سحب قرض محدد آخذه في تاريخ لاحق - سحب مسبق لقرض محدد آجل اىستحقاقه بتاريخ لاحقمتأخر.

A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again.

Delayed Draw Term Loans Financial Edge

7 3 Classification Of Preferred Stock

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

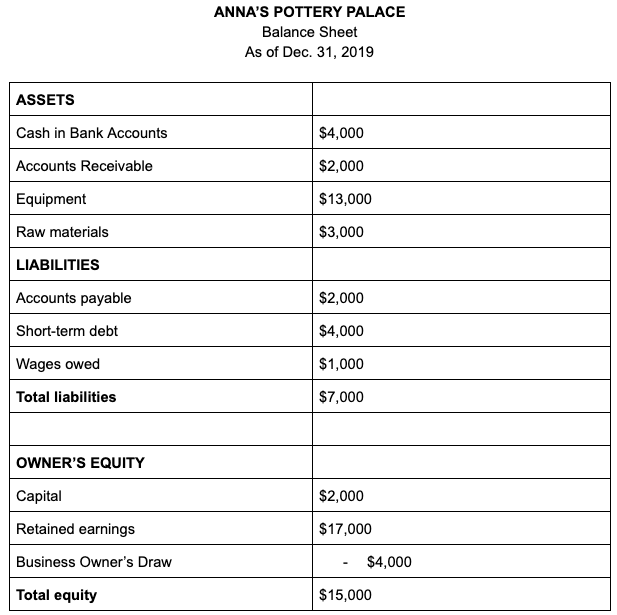

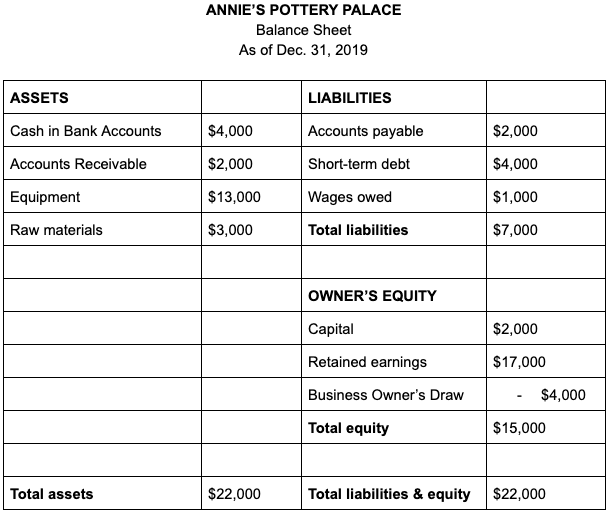

What Are Liabilities In Accounting With Examples Bench Accounting

7 3 Classification Of Preferred Stock

Understanding The Construction Draw Schedule Propertymetrics

What Is The Current Portion Of Long Term Debt Bdc Ca

Advanced Lbo Modeling Test 3 Hour Training Tutorial

2 2 Accounting For A Guarantee Under Asc 460

Debt Schedule Roll Forward Modeling Tutorial

What Are Liabilities In Accounting With Examples Bench Accounting

Financing Fees Deferred Capitalized And Amortized Types

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Types Of Term Loan Payment Schedules Ag Decision Maker

Debt Schedule Video Tutorial And Excel Example

/liability_finalv2-ce102fb03b734ee1ad4674125a87a2a1.png)